expanded child tax credit build back better

In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit CTC. As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP expanded Child Tax Credit CTC as a centerpiece of the legislation.

A Recap You Didn T Need Build Back Better Was Popular All Year

Congressman Brian Higgins expressed his support to extend the expanded Child Tax Credit for the next five years through the Build Back.

. Thus far Democrats have failed to pass to the Build Back Better package through a simple majority which would expand the maximum credit of 3600 per child under age six and 3000 for children. The version of the Build Back Better Act that passed the House in November included a one-year extension of the expanded child tax credit. Expanded child tax credit.

The Build Back Better Act extends the expanded Child Tax Credit as well as the expanded Earned Income Tax Credit and the tax credit to help pay for child and dependent care. But that bill has stalled in the Senate because of. Adding to the deadline pressure for Build Back Better is the warning by Senate finance committee chairman Ron Wyden D-OR that the child tax credit credit needs to be extended by December 28 so.

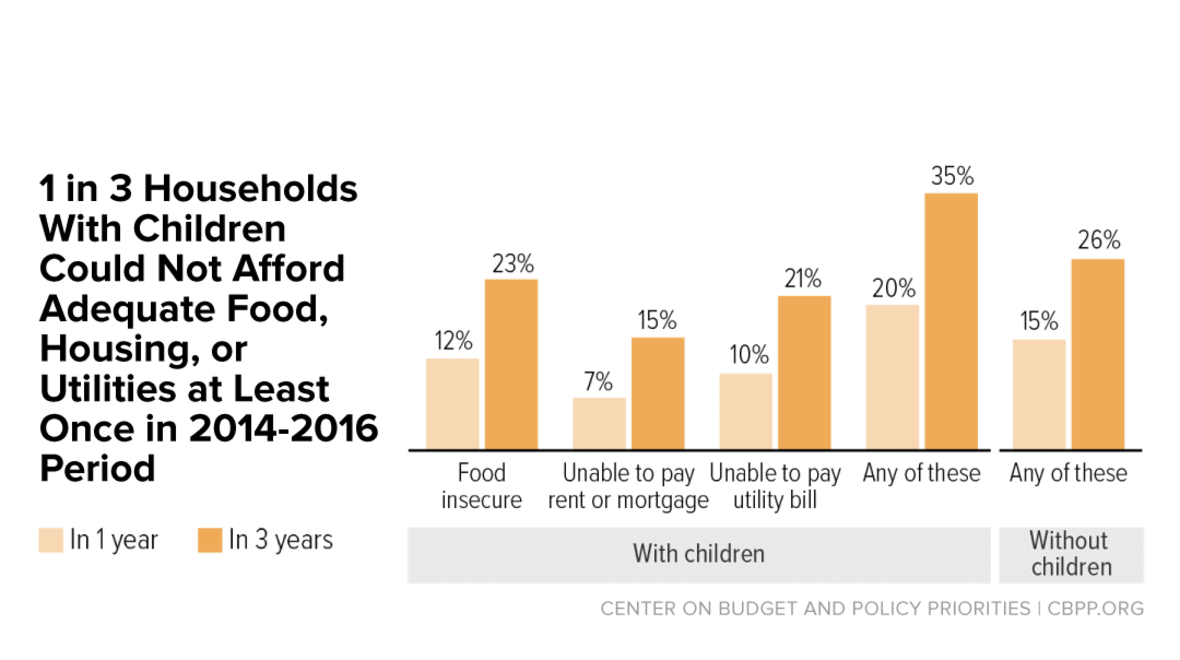

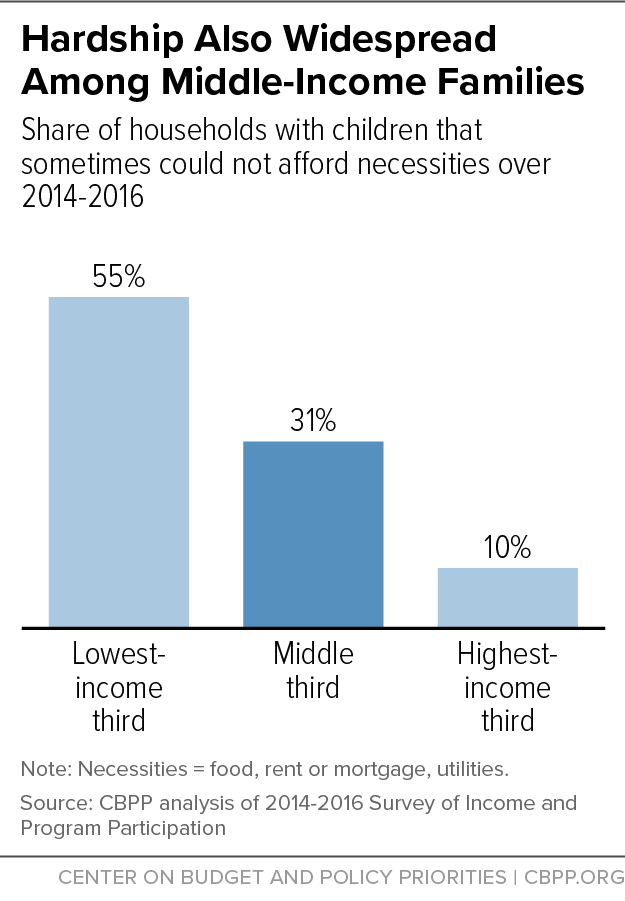

The American Rescue Plan which Biden signed into law in March 2021 increased the maximum child tax credit amount from 2000 to 3600 per child ages 5 and under and 3000 for those between the. Monthly child tax credit expires Friday after Congress failed to renew it Because the Build Back Better agenda was not passed by the Senate before the end of the year the last payment of the. The expanded CTC represents the biggest investment in American families and children in a generation.

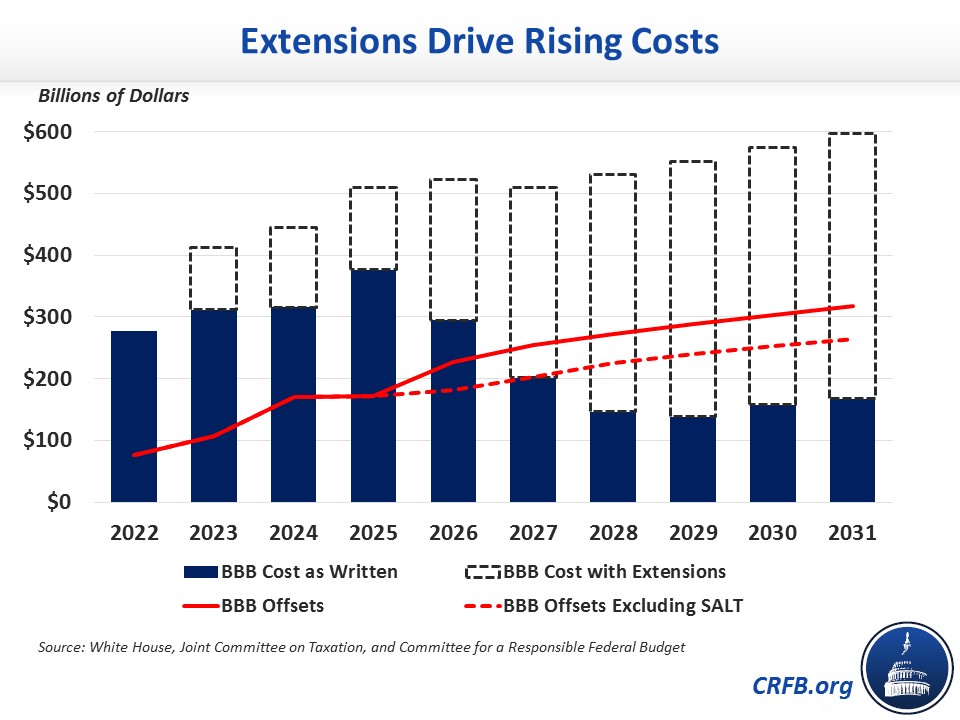

Last year 44 of adults reported they had skipped at least one medically necessary prescription drug due to cost. The Build Back Better bill would raise the SALT deduction cap from 10000 to 80000 for 10 years. Effects of the Build Back Better Act on the.

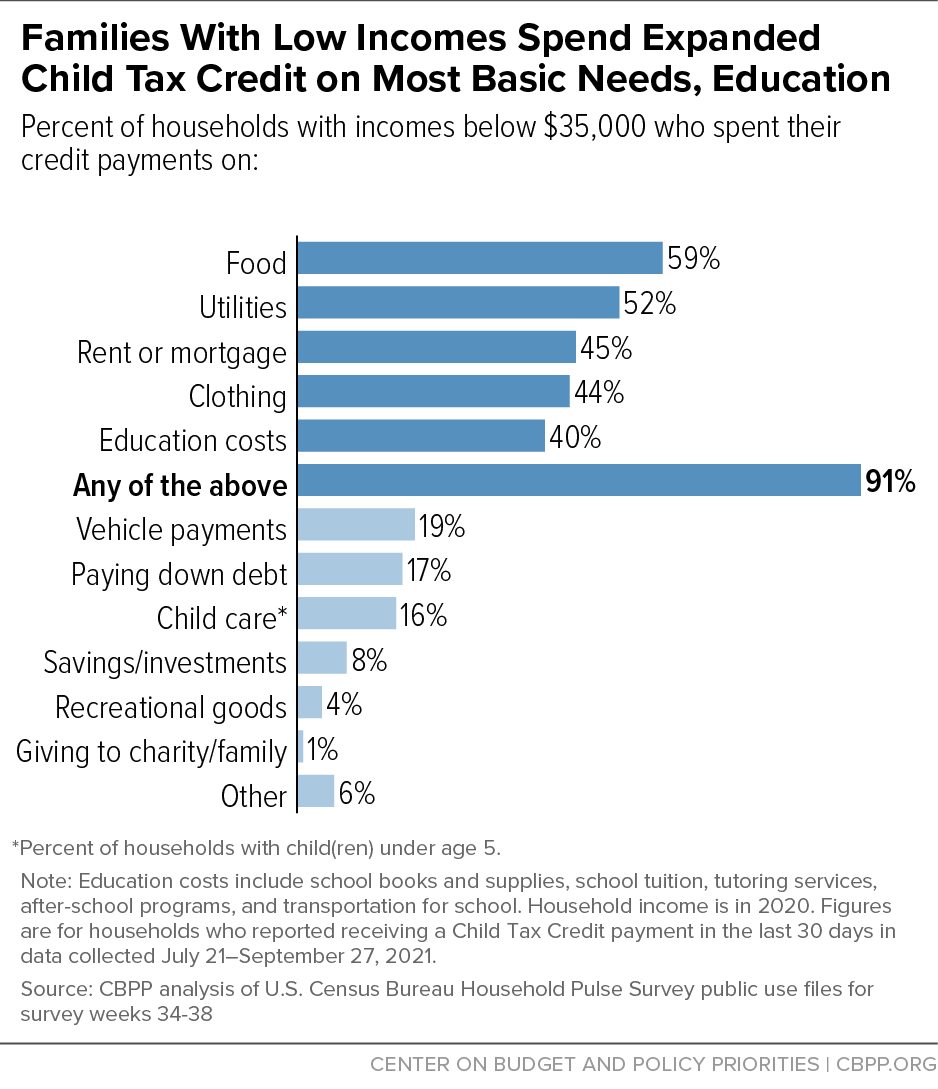

The ARP increased the credit to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 note also that it increased the maximum age for an eligible child from 16 to 17. Since July of 2021 this provision sent low-income families monthly payments of 300 per child under six years old and 250 for a child under 17 years old. The expanded child tax credit was in place for the last seven months of 2021 after it was passed as part of the American Rescue Plan Act.

The House approval of the Build Back Better Act on Friday paved the way for extending the credit into the 2022 tax return season but Markey other progressive lawmakers and many health officials. The tax credit was expanded earlier this year and increased the amount taxpayers can receive per child from 2000 to 3000 for children over the age of six and from 2000 to 3600 for children. A group of Democratic senators wrote a letter last week urging the president not to abandon the idea of the 2021 version of the child tax credit.

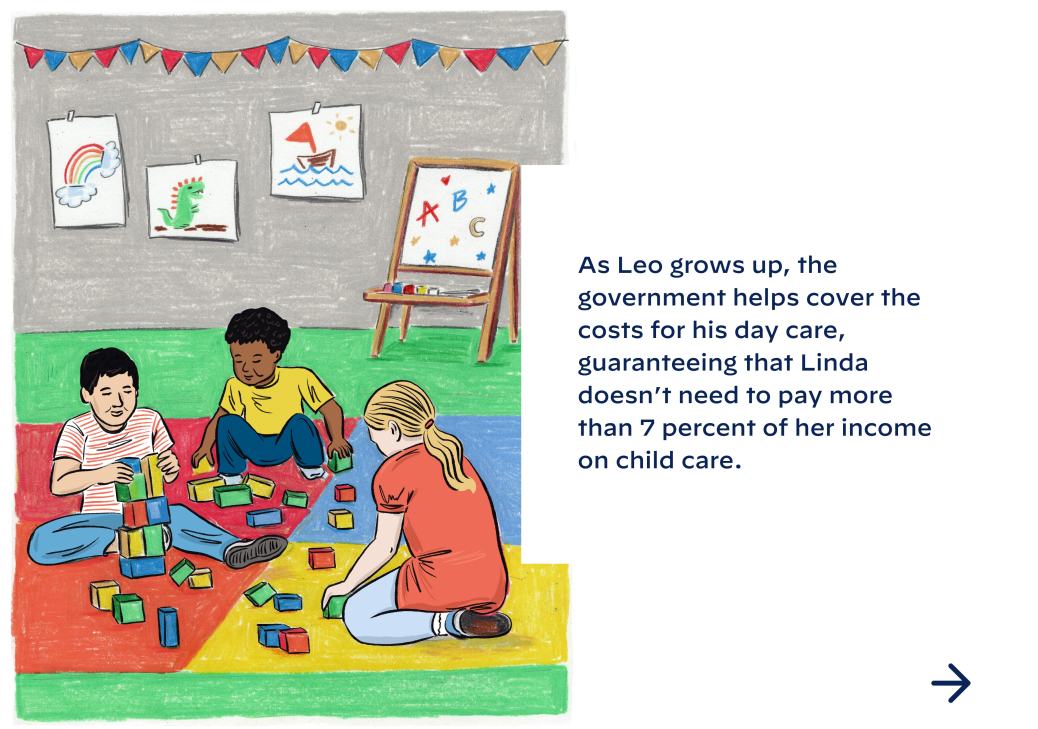

Beyond child care support Build Back Better also includes the permanent expansion of the Child Tax Credit which expired in 2022. Under Build Back Better families could receive advance Child Tax Credit payments of 300 per child under 6 and 250 per child ages 6-17 via Direct Deposit for the entirety of 2022. The child tax credit is a commonsense and transparent policy priority that Republicans themselves championed and ran on 25 years ago.

That increase begins to tail off sharply for couples making over 150000 and is gone. The policy approved this spring as part of the American Rescue Plan made three key changes to the child tax credit a provision that. Committing to responsibly improving the child tax credit as a.

The child tax credit was expanded for one year under the American Rescue Plan Act of 2021 ARP. Next CTC payment deposited into bank accounts on Oct. The House Build Back Better legislation would ensure that families continue to get a significantly expanded Child Tax Credit via monthly payments through 2022.

The expanded credit was set to be extended in the Build Back Better Act President Joe Bidens massive public investment bill overhauling health care. That bill saw the child tax credit increase this year. The money in total supported 61 million children.

The Build Back Better Act increases the Child Tax Credit by 1000 to 1600 depending on the childs age. And it would permanently make the full credit available to children in families with low or no earnings in a year locking in substantial expected reductions in child poverty. The Build Back Better bill would formalize expansions made to child tax credit policy established under the American Rescue Plan Act signed by Biden in March.

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

The Build Back Better Framework The White House

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

The Build Back Better Plan Is Stalling What S The Issue

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

The Build Back Better Framework The White House

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Build Back Better Cost Would Double With Extensions Committee For A Responsible Federal Budget

The Build Back Better Framework The White House

The Build Back Better Framework The White House

A Recap You Didn T Need Build Back Better Was Popular All Year

Child Care And Pre K In The Build Back Better Act A Look At The Legislative Text